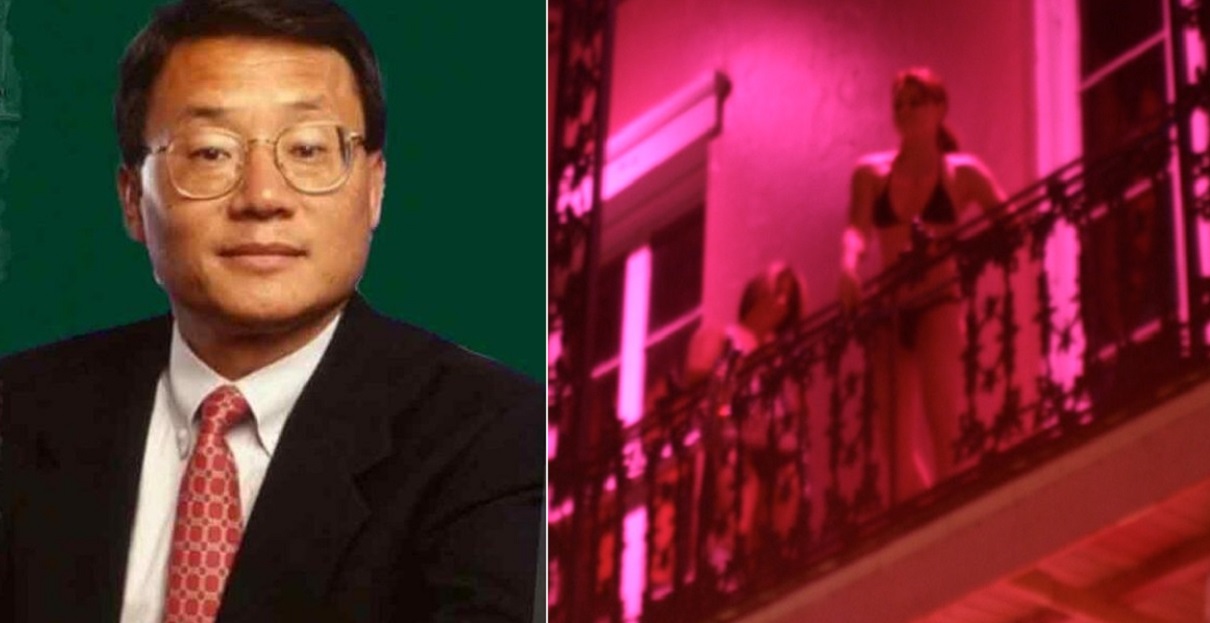

Was Lou Pai the luckiest man in the Enron debacle or a financial Houdini? His ability to extract hundreds of millions of dollars from Enron before its catastrophic collapse in 2001 has cemented his place as a pivotal, albeit enigmatic, figure in one of corporate America's most infamous scandals.

Lou Lung Pai, a Chinese-American businessman, is best known for his role as a top executive at Enron. Born in Nanjing, China, in 1947, Pai's career trajectory took him to the upper echelons of the energy giant, where he served as CEO of Enron Energy Services from March 1997 to January 2001, and subsequently as CEO of Enron Xcelerator, the company's venture capital division, from February 2001 until June 2001. His departure from Enron just months before its downfall allowed him to amass a fortune, primarily through exercising stock options and selling shares.

| Category | Information |

|---|---|

| Full Name | Lou Lung Pai (Chinese Pinyin: Bi Lulng) |

| Birth Year | 1947 |

| Birthplace | Nanjing, China |

| Nationality | Chinese-American |

| Education | Not publicly available in detail |

| Career Highlights |

|

| Controversies |

|

| Net Worth | Estimated $250 million+ at the time of Enron's collapse; current net worth not publicly available |

| Family | Former wife: Lanna Pai; two children |

| Current Status | Businessman, Founder of Element Markets |

| Reference | Bloomberg |

His financial acumen, or perhaps something more sinister, enabled him to walk away with over $250 million, leaving many to question the circumstances surrounding his departure and subsequent enrichment. Pai's story is not just one of corporate success; it's a complex narrative intertwined with allegations of insider trading, marital discord, and a lavish lifestyle that stood in stark contrast to the devastation experienced by Enron's employees and shareholders.

- Tiffany Pollards Net Worth 2024 How Rich Is New York Really

- Boosie Badazzs Net Worth The Untold Story 2024 Update

Pai's journey to Enron involved previous roles at ConocoPhillips and DuPont, providing him with a robust background in the energy sector. At Enron, he oversaw the company's retail energy unit, a position that placed him at the heart of the firm's operations. He was regarded by some colleagues as exceptionally intelligent, while others attributed some of Enron's significant business failures to his leadership. Regardless, his ability to navigate the complexities of the energy market and capitalize on opportunities remains a subject of intense scrutiny.

The timeline of Pai's financial transactions is particularly striking. He left Enron approximately six months before the company's collapse in late 2001, reportedly pocketing more than $265 million from exercising Enron options and selling stock. This timing, coupled with the subsequent revelations of Enron's fraudulent accounting practices, fueled speculation about his knowledge of the company's impending doom. The Securities and Exchange Commission (SEC) investigated Pai's stock sales, ultimately leading to a settlement of civil insider trading charges.

The fallout from Enron's collapse extended beyond the financial realm for Pai. His 20-year marriage to Lanna Pai, with whom he had two children, ended in divorce after she discovered his affair. The divorce settlement required Pai to liquidate approximately $250 million of his Enron stock, a move that fortuitously occurred just months before the company's stock prices plummeted, triggering its eventual bankruptcy.

- Jocko Willink Gear Independence Day Shirts More Fuel Your Freedom

- Jordan Spieth 2024 Stats Earnings Net Worth Golf News

Despite the controversies and investigations, Pai was never charged with any criminal wrongdoing in the Enron scandal. He invoked his Fifth Amendment rights in relation to the Enron class action lawsuits, protecting himself from self-incrimination. However, as a result of one lawsuit, Pai forfeited $6 million due to him from Enron's insurance policy for company officers, contributing the funds to a settlement for Enron shareholders.

While Kenneth Lay and Jeffrey Skilling served as the public faces of Enron, projecting an image of prosperity and success, Lou Pai operated largely behind the scenes, amassing considerable wealth and avoiding the criminal charges that befell his colleagues. Lay and Skilling were ultimately found guilty by a federal jury after a lengthy trial that exposed the depth of Enron's fraudulent activities.

The collapse of Enron in the fall of 2001 sent shockwaves through the financial world, wiping out the fortunes and retirement savings of thousands of employees. The exposure of the company's deceptive accounting practices revealed a culture of greed and corruption at the highest levels. Enron's downfall served as a stark reminder of the potential for corporate malfeasance and the devastating consequences it can have on individuals and the economy.

Beyond his involvement with Enron, Pai is also known as the founder of Element Markets, a company focused on environmental commodities and renewable energy credits. This venture represents a shift in focus from traditional energy trading to a more sustainable and environmentally conscious approach. Element Markets engages in the trading of various environmental products, including renewable energy credits, carbon offsets, and emission allowances.

Element Markets' activities align with the growing global emphasis on renewable energy and emissions reduction. The company provides services to organizations seeking to comply with environmental regulations or achieve sustainability goals. By facilitating the trading of environmental commodities, Element Markets contributes to the development of a more sustainable energy sector.

The company's involvement in renewable energy credits (RECs) helps to support the growth of renewable energy sources, such as solar, wind, and hydro power. RECs represent the environmental attributes of renewable energy generation and are used by utilities and other entities to meet renewable energy mandates. Element Markets' expertise in REC trading enables these entities to efficiently source and manage their renewable energy obligations.

In addition to RECs, Element Markets also trades in carbon offsets, which are used to compensate for greenhouse gas emissions. Carbon offset projects involve activities that reduce or remove carbon dioxide from the atmosphere, such as reforestation, renewable energy development, and energy efficiency improvements. Element Markets' participation in the carbon offset market helps to incentivize these projects and promote emissions reductions.

The company's engagement in emission allowance trading supports the implementation of cap-and-trade programs, which are designed to reduce air pollution by setting limits on emissions and allowing companies to trade allowances to meet those limits. Element Markets provides expertise in emission allowance trading to help companies navigate these complex regulatory frameworks.

Element Markets' focus on environmental commodities and renewable energy credits reflects a growing awareness of the importance of sustainability and environmental responsibility. The company's activities contribute to the development of a more sustainable energy sector and help to mitigate the impacts of climate change.

In the wake of the Enron scandal, Pai's actions have been subjected to intense scrutiny and debate. Some view him as a shrewd businessman who simply capitalized on opportunities, while others criticize him for profiting from a company that ultimately defrauded its employees and shareholders. Regardless of one's perspective, Pai's story serves as a cautionary tale about the potential for corporate greed and the importance of ethical leadership.

The contrast between Pai's immense wealth and the financial devastation experienced by Enron's employees is particularly jarring. While he walked away with over $250 million, thousands of employees lost their jobs, retirement savings, and health insurance. This disparity highlights the inherent inequalities of the corporate world and the potential for those at the top to benefit at the expense of those below.

The Enron scandal led to significant reforms in corporate governance and accounting practices. The Sarbanes-Oxley Act of 2002 was enacted to enhance corporate responsibility, increase financial transparency, and strengthen audit oversight. These reforms were intended to prevent future Enron-like scandals and protect investors and employees from corporate fraud.

Despite the reforms, corporate malfeasance remains a persistent challenge. The Enron scandal served as a wake-up call, but it did not eliminate the potential for greed and corruption in the corporate world. Ongoing vigilance and strong regulatory oversight are essential to ensure that companies operate ethically and responsibly.

Pai's legacy remains complex and controversial. His success in extracting wealth from Enron before its collapse has made him a symbol of corporate excess and questionable ethics. However, his subsequent involvement in Element Markets suggests a potential shift toward a more sustainable and environmentally conscious approach. Ultimately, Pai's story is a reminder of the importance of ethical leadership, corporate responsibility, and the need for strong regulatory oversight to prevent future corporate scandals.

The Enron scandal also highlighted the role of auditors and other gatekeepers in preventing corporate fraud. Enron's auditor, Arthur Andersen, was found guilty of obstruction of justice for shredding documents related to the company's financial statements. This case underscored the importance of auditor independence and the need for rigorous oversight of accounting practices.

The Enron scandal also had a significant impact on the energy industry. The company's collapse led to increased scrutiny of energy trading practices and the development of new regulations to prevent market manipulation. These reforms were intended to ensure that energy markets operate fairly and transparently.

The Enron scandal also raised questions about the role of credit rating agencies in assessing corporate risk. Enron's credit rating remained high until just weeks before its collapse, despite growing concerns about the company's financial health. This case highlighted the potential for conflicts of interest and the need for greater transparency in the credit rating process.

The Enron scandal also underscored the importance of whistleblowers in exposing corporate fraud. Sherron Watkins, an Enron employee, alerted the company's chairman, Kenneth Lay, to concerns about the company's accounting practices. Her actions helped to bring the company's fraudulent activities to light and ultimately led to its downfall.

The Enron scandal also highlighted the importance of media scrutiny in holding corporations accountable. Journalists played a critical role in uncovering Enron's fraudulent activities and bringing them to the attention of the public. Their work helped to expose the company's wrongdoing and contributed to its ultimate collapse.

The Enron scandal also led to increased awareness of the risks associated with investing in complex financial instruments. Enron's use of special purpose entities (SPEs) to hide debt and inflate profits was a key factor in its downfall. This case underscored the importance of understanding the risks associated with complex financial transactions.

The Enron scandal also highlighted the importance of diversification in investment portfolios. Many Enron employees had invested a significant portion of their retirement savings in Enron stock. When the company collapsed, they lost a large portion of their retirement funds. This case underscored the importance of diversifying investments to reduce risk.

The Enron scandal also led to increased scrutiny of executive compensation practices. Enron's executives were richly compensated, even as the company was facing financial difficulties. This case raised questions about the fairness of executive compensation and the need for greater accountability in executive pay.

The Enron scandal also highlighted the importance of ethical leadership in the corporate world. Enron's leaders prioritized personal gain over the interests of their employees and shareholders. This case underscored the need for ethical leaders who are committed to doing what is right, even when it is difficult.

The Enron scandal also served as a reminder that corporate success is not always sustainable. Enron's rapid growth and impressive financial performance masked underlying problems that ultimately led to its downfall. This case underscored the importance of building a sustainable business model based on ethical principles and sound financial management.

Lou Pai's story, inextricably linked to the rise and fall of Enron, continues to fascinate and provoke debate. While his financial maneuvers may have been legal, the ethical implications of his actions remain a subject of intense scrutiny. Whether he is viewed as a shrewd opportunist or a symbol of corporate greed, Pai's legacy will forever be intertwined with one of the most significant financial scandals in American history. His tale serves as a lasting reminder of the importance of transparency, accountability, and ethical leadership in the world of business.

The architectural term mentioned, pailou or paifang, while briefly touched upon, is a traditional Chinese gateway with symbolic and memorial significance, adding an interesting, albeit tangential, cultural note. It underscores the rich cultural heritage from which Lou Pai hails, even as his career unfolded within the high-stakes world of American corporate finance.

Kyle Pai, the son of Lou and Melanie Pai, has deliberately maintained a low profile, steering clear of the public eye despite his family's controversial history. Information about his education, career, and personal life is scarce, suggesting a conscious decision to distance himself from the notoriety associated with his father's involvement in the Enron scandal. His choice to live a private life is perhaps a reflection of the intense scrutiny and public attention that his family has faced.

The guilty verdicts reached at the Enron trial for Kenneth Lay and Jeffrey Skilling, though Pai himself avoided criminal charges, serve as a stark reminder of the consequences of corporate fraud. The contrast between their fates and Pai's underscores the complexities of the legal system and the challenges of holding individuals accountable for their actions in the context of large-scale corporate scandals.

- Jake Ryans Secret Michael Schoefflings Furniture Art Today

- Olga Kurylenko From Ukraine To Bond Girl Beyond